ASPERMONT: SEPTEMBER 2017 QUARTERLY SAAS METRICS UPDATE

Consistent with Aspermont's accelerated growth strategy we are pleased to report:

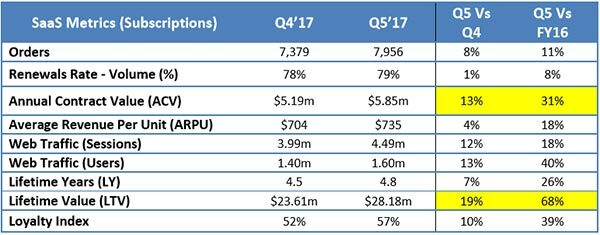

- Annual Contract Value (ACV) grew by 13% to $5.85m (over the last quarter); and

-

Subscription revenue and cash collections increased by 31% (compared to the previous corresponding period);

- Average Revenue Per User (ARPU) increased to $735;

- Lifetime Value (LTV) of subscriptions grew by 19% to $28.2m (over the last quarter).

Subscriptions development is the cornerstone of Aspermont's current and future business models which is why we draw specific investor attention to the performance of this income stream.

Our core strategy is to grow the subscription base with cash generative, recurring incomes and to supplement this with complementary revenue from advertising, events and other avenues of sponsorship income.

Q5'17* SaaS Subscriptions Metrics Update

*Note: - Aspermont has changed the fiscal reporting date to 30th September annually, as announced on 28th July 2017. Consequently Aspermont has a single "stand alone" quarter in calendar 2017, referred to as Q5'17.

Notes to accounts:

Figure represented are related to the Group's subscriptions business only

- Variance in $ amounts with Aug-17 numbers owes to a shift from constant currency to reported currency

- Variance in orders with Aug-17 numbers is due to a double counting correction

- For all future updates of these metrics we shall present on a reported currency basis

Growth and Run Rate Summary

- Digital activity (sessions and users) continues to show powerful growth; and

- ARPU, Renewal Rates and Order building together underline strength of model in all aspects;

- Significant $4.5m (19%) growth in LTV in this quarter. Definitions and Calculation

Definitions and Calculations

| SaaS | Software as a Service |

| Orders | Number of live subscriptions at end of period |

| Renewal Rate Volume | Volume of subscriptions renewed over trailing twelve month basis which is the inverse of Churn Rate |

| Annual Contract Value | Aggregate contract cash value of all live subscriptions at the end of a period. (note - 99% of all ASP subscriptions are 12 month contracts) |

| Average Revenue per Unit | Annual Contract Value / Orders |

| Sessions | Total number of web sessions over a trailing twelve month basis |

| Users | Total number of users who initiated at least one web session over a trailing twelve month basis |

| Lifetime Years | Average lifetime of a subscription = 100/Churn Rate |

| Lifetime Value | Aggregate of present and future value of all subscriptions Lifetime Year x Annual Contract Value |

| Loyalty Index | Internal metric analysis of subscriber loyalty through their engagement. Subscribers are classified as Fans, Frequents, Occasionals, Fly-Bys and No Shows based on their engagement |

Upcoming Events

- 16/06/2026

- Mining News Select Australia 2026

- 16/06/2026

- Future of Mining Australia 2026